Why Closing Costs Vary So Dramatically by Property Type

At a glance, a home is a home. But legally and financially, these property types are entirely different assets.

- Single-family homes → traditional real property ownership

- Condos → deeded ownership + shared governance

- Co-ops → shares in a corporation, not real estate

Each structure brings its own taxes, approvals, fees, and risks—and those differences show up sharply at the closing table.

Single-Family Home Closing Costs: The Cleanest Math

Single-family homes typically come with the lowest and most predictable closing costs, particularly outside dense urban cores.

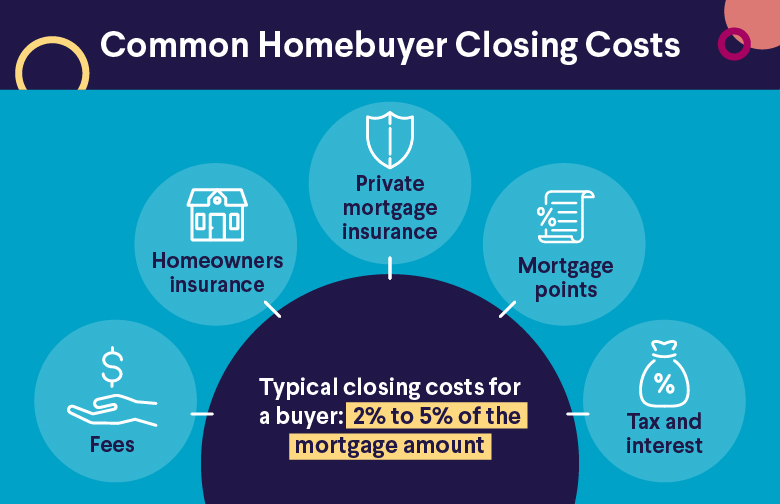

Typical Buyer Closing Costs:

- Title insurance

- Attorney fees

- Mortgage recording tax (where applicable)

- Lender fees

- Appraisal and inspection

Why Buyers Love Them:

- No board approvals

- No building applications

- No move-in or move-out fees

- No flip taxes

Bottom line: fewer variables, fewer third parties, and fewer surprises.

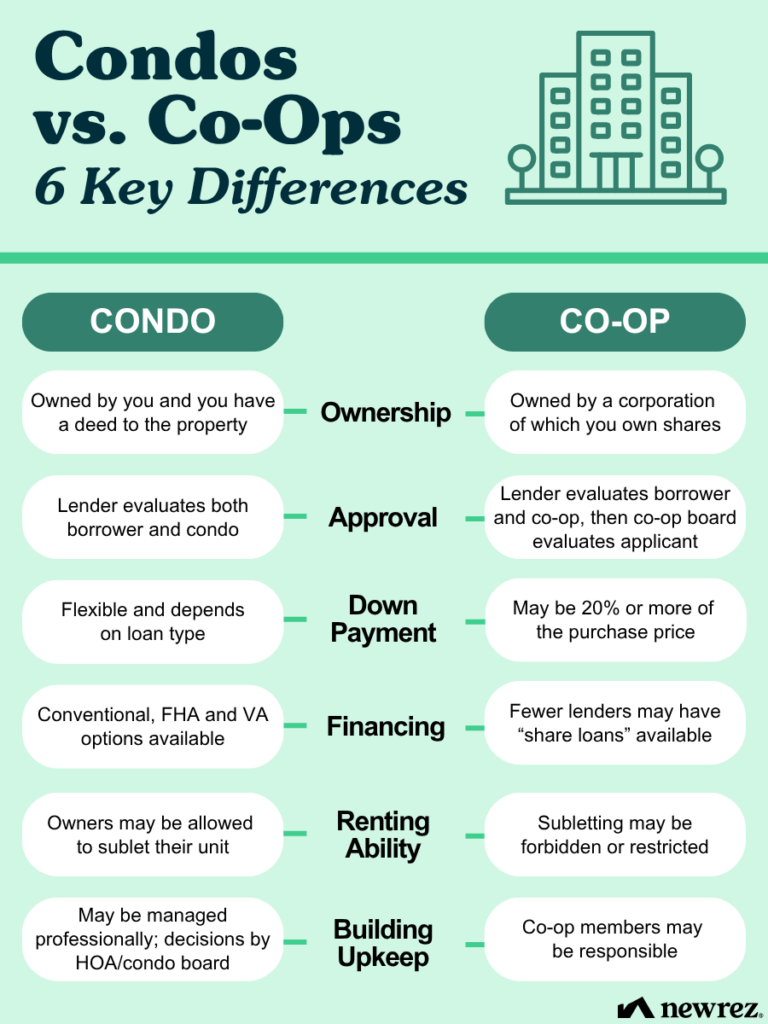

Condo Closing Costs: Familiar—but More Expensive Than Most Expect

Condos feel similar to single-family homes, but closing costs tell a different story.

Condo-Specific Buyer Costs Often Include:

- Condo application and processing fees

- Building document fees

- Common charge and tax adjustments

- Move-in / move-out deposits

- Working capital or reserve contributions

In many markets, buyers may also pay:

- Transfer taxes

- Higher attorney and lender coordination fees

Condos still require title insurance and recorded deeds—but the building itself adds another financial layer.

Co-Op Closing Costs: Lower Up Front—Higher Complexity

Co-ops are often advertised as “cheaper to buy,” and on paper, closing costs can be lower.

But that’s only half the story.

Typical Co-Op Buyer Costs:

- Board application fees

- Credit check and background fees

- Attorney fees (often higher due to board scrutiny)

- Maintenance and tax adjustments

What Buyers Usually Don’t Pay:

- Title insurance

- Mortgage recording tax (in many cases)

The Trade-Off:

- Board approval risk

- Longer closing timelines

- Stricter liquidity and debt-to-income rules

- Potential flip taxes when selling

Co-ops exchange lower transactional costs for reduced flexibility and higher gatekeeping.

The Hidden Cost Most Buyers Miss: Time, Risk, and Leverage

Closing costs aren’t just line items—they reflect risk exposure.

- Board delays can kill rate locks

- Rejected co-op applications can void deals

- Condo transfer taxes can erase perceived savings

- Single-family homes usually close faster and cleaner

In competitive and luxury markets, certainty has monetary value.

If timing, certainty, and leverage matter to you, read:

Quick Comparison: Buyer Closing Costs by Property Type

Property Type | Buyer Closing Costs | Complexity | Risk |

Single-Family Home | Lowest | Low | Low |

Condo | Moderate to High | Medium | Medium |

Co-Op | Low to Moderate | High | High |

Which Property Type Is “Best”?

There’s no universal answer—only the right answer for your priorities.

- Want simplicity and control? → Single-family

- Want amenities and liquidity? → Condo

- Want lower purchase price and long-term stability? → Co-op

But here’s the truth most buyers learn too late:

The least expensive property to buy is often the most expensive one to exit.

Why Sophisticated Buyers Work With Specialists

Closing costs are just the surface layer.

An experienced advisor helps you understand:

- Which fees are negotiable

- Which buildings create friction

- Which ownership structures preserve resale value

- Which “cheap” deals quietly cost more

That’s the difference between buying real estate and buying well.

Ready to Talk Strategy?

If you’re considering a purchase and want:

- A clear estimate of real closing costs

- Advice tailored to your financial goals

- A strategy that protects both entry and exit value

👉 Book a Buyer Strategy Call